All Categories

Featured

Take Into Consideration Using the DIME formula: penny stands for Debt, Income, Home Loan, and Education. Total your debts, home mortgage, and university expenditures, plus your income for the variety of years your household requires protection (e.g., till the youngsters are out of your home), and that's your protection need. Some financial experts determine the amount you need utilizing the Human Life Worth viewpoint, which is your lifetime revenue potential what you're making currently, and what you expect to earn in the future.

One way to do that is to try to find companies with strong Economic stamina ratings. life insurance 10 year term meaning. 8A business that finances its own policies: Some firms can sell plans from another insurance firm, and this can add an extra layer if you intend to alter your policy or in the future when your family members needs a payout

A Term Life Insurance Policy Matures Upon Endowment Of The Contract

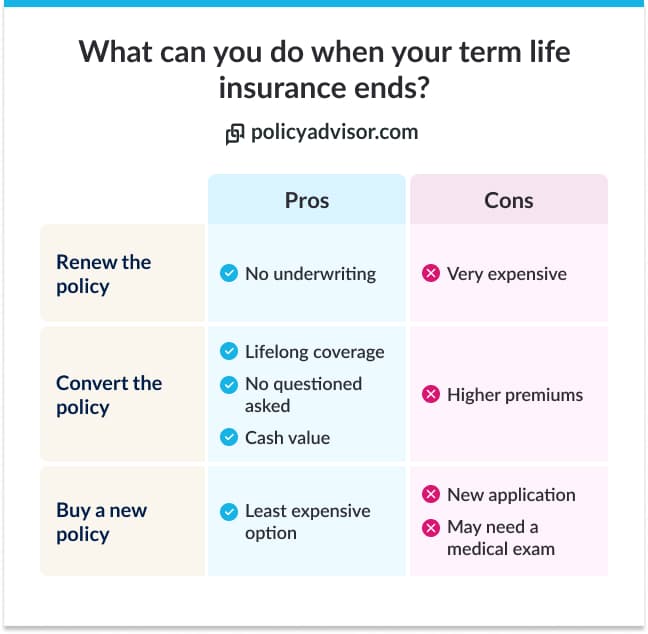

Some business provide this on a year-to-year basis and while you can expect your prices to increase significantly, it may be worth it for your survivors. One more means to contrast insurance provider is by looking at online customer reviews. While these aren't likely to tell you a lot concerning a firm's financial security, it can inform you exactly how simple they are to collaborate with, and whether cases servicing is a trouble.

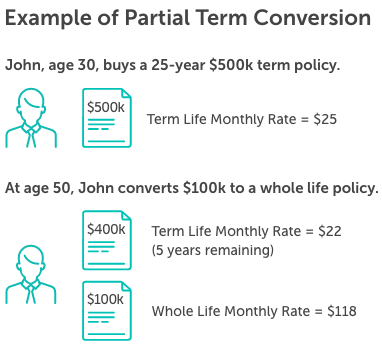

When you're more youthful, term life insurance policy can be a simple means to protect your liked ones. As life adjustments your economic top priorities can as well, so you may want to have entire life insurance for its lifetime coverage and added advantages that you can utilize while you're living. That's where a term conversion can be found in - short-term life insurance.

Approval is assured regardless of your health. The costs won't increase once they're set, but they will increase with age, so it's a good concept to lock them in early. Discover out more concerning exactly how a term conversion functions.

1Term life insurance policy provides short-term defense for an important duration of time and is usually less expensive than irreversible life insurance coverage. a return of premium life insurance policy is written as what type of term coverage. 2Term conversion guidelines and constraints, such as timing, may apply; for instance, there may be a ten-year conversion privilege for some products and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance coverage Purchase Alternative in New York. 4Not available in every state. There is a cost to exercise this cyclist. Products and bikers are readily available in accepted jurisdictions and names and functions might vary. 5Dividends are not ensured. Not all participating plan proprietors are qualified for dividends. For select cyclists, the condition relates to the insured.

Latest Posts

A Return Of Premium Life Insurance Policy Is Written As What Type Of Term Coverage

Level Term Life Insurance Advantages And Disadvantages

Cheap Burial Insurance For Seniors